Big Business Funding for Small Business Growth

- NO-OBLIGATION QUOTES AVAILABLE

- ACCESS TO £3k to £3 MILLION FUNDING

- GET A FAST DECISION

- MINIMAL PAPERWORK

- 90% APPROVAL RATE

- ALTERNATIVE FINANCE

Business Cash Advances

Is it time to grab that business opportunity with both hands?

Your East Anglian Business Funding Solutions include:

- Business Loans (secured or unsecured) – borrow between £3,000 & £3 million and spread the repayments

- Asset Finance – a loan secured against assets within your business

- Invoice Finance – an unpaid invoice is used as security for your funding, giving you swift access to a percentage of its value

- Commercial Mortgages – a mortgage loan secured against your commercial property

- Cash flow Finance – a loan based on past and predicted cash flow

- Bridging Loans – a short-term loan from around 1 – 24 months

- VAT/HMRC Funding – used to repay VAT bills and avoid costly fees and penalties

When it’s time to invest in your future, business funding from East Anglian Business Solutions is the rapid, reliable option for small business growth.

Perhaps you need a secured or unsecured business loan to expand. Maybe cash flow finance would be the right option right now. Whatever your needs, we help you cut through the confusion and find your best business finance option.

From retail and hospitality to eCommerce, East Anglian Business Solutions helps hundreds of businesses secure funding when it’s time to expand, invest and progress. We lead with good old-fashioned relationships which must be why so many of our lovely customers return.

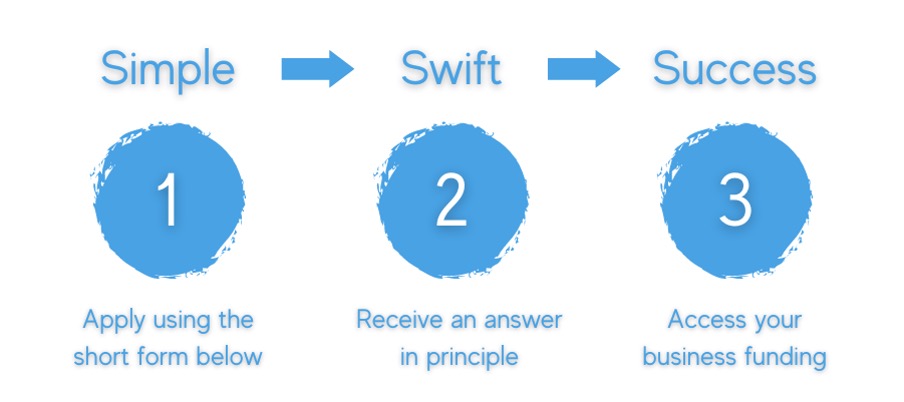

Applying for Business Funding Made Easy

If you prefer to talk to actual people (madness, we know), we will gladly help. How much would you like to lend? What is your current business situation? Over how long would you prefer to repay the funds? We don’t help you make a quick decision. We help you make the right decision.

Simple – Swift – Success!

Can East Anglian Business Solutions support your business journey?

Complete the form below to start your business funding application today.

Get access to funding for:

Cash Flow

EXPANSION

RENOVATION

EQUIPMENT

TAX PAYMENT

MARKETING

STOCK

RELOCATION

DEBT CONSOLIDATION

Apply For Finance Online Today!

Types of businesses we can help

Fast Restaurant Funding

Whether you’re branching out to new premises, investing in a top chef or covering a quiet period, restaurant loans can help establishments like yours keep putting food on the table. We’ve been supporting UK businesses since 2014 – and our food industry finance solutions could be the right answer for you.

The number of UK restaurants has grown by 2.5% in the past five years – yet tough competition, low staff retention and high failure rates can make it difficult for restaurant owners to access traditional funding. Learn how our business loans could help your establishment get a share of the pie.

Flexible Financing For Pubs

Although the pub and bar sector remains one of the largest and most successful in the UK, recent times have certainly been challenging.

We know that investing, innovating and staying ahead of the competition is essential to maintaining success. Due to the seasonal nature of the trade, many owners may have been turned down by traditional lenders, such as banks, for pub business loans. Not securing precious pub finance when you need it can be incredibly damaging to your business’ progress.

However, if you have been denied a pub loan by the bank, we offer solutions in the form of alternative financing. With us, payback is in line with your income, making it the perfect solution for anyone working in a seasonal industry like the pub trade.

Contact us today to discuss your requirements.

Retail Finance Solutions To Grow Your Small Business

Do you own a retail business? Whether you run a gift shop or fashion boutique, a toy store or furniture outlet, you might need a financial boost now and then to balance your cash flow or to help your business grow.

We provide retail finance options to help your business flourish, and these have been created with small businesses such as yours in mind. As well as being a useful way to secure funding, a business cash advance from us is an ideal alternative to a bank loan. Plus, we can give you quick access to the funds you need.

If you’ve only recently set up your retail business or you’ve not had to research alternative funding before, this might be the first time you’ve come across dedicated retail finance options.

Contact us today for a no obligation chat

Business Loans for Salons

Customer loyalty is fragile, so it is the hairdressers and beauticians that stay price competitive, customer focused and marketing savvy that will gain and retain customers. But enticing clients through the door requires investment in marketing, particularly website and social media as well as facilities, interior and exterior décor and, of course, the very latest equipment.

A study by Mintel shows that if you can get a customer in for one treatment, they’re more likely to book another on the day or in the future. Do you have the right staffing levels, treatment facilities and equipment so that you don’t have to turn away business? Once a customer goes elsewhere, it’s hard work to get them back.

Your first point of call for business finance might be the bank, but what if you are turned down or have been refused capital previously? Don’t let this be a setback to your business goals. Our business finance could be your best option.

Contact us today for a chat about how we can help.

Get a Business Loan for your Hotel or Bed & Breakfast

There are over 45,800 hotels in the UK and an estimated three quarters of those are independently run businesses. This figure includes branded chain hotels, bed and breakfast accommodation and serviced budget rooms.

Although the hospitality sector is strong in the UK, it’s seasonal and sometimes unpredictable which means that traditional funders like banks aren’t always keen to lend.

That’s why we’ve built a finance product around your business to help you grow or just plug a seasonal cash flow gap.